RBI Continues With Dovish Accommodative Stance, Policy Rates Remain Unchanged

#

4th Dec, 2020

- 44852 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

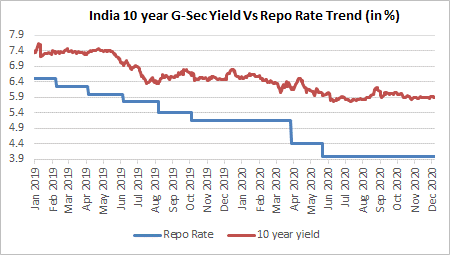

As widely expected, the RBI Monetary Policy Committee (MPC) unanimously voted to keep the key policy rate (repo rate) unchanged at 4.0%, and the reverse repo rate unchanged at 3.35%. However, the MPC continued with their dovish undertone of maintaining an accommodative stance through next fiscal year—to support growth on a durable basis.

Source: Bloomberg

Headline consumer inflation has been above the RBI MPC’s 6% upper limit for a while now (headline CPI inflation was elevated at 7.6%YoY in October 2020), and RBI mentioned that inflation outlook has turned adverse relative to expectations in the past two months. Therefore, the central bank revised upwards its inflation forecasts quite substantially. It now projects headline consumer inflation at 6.8% for Q3 FY21 (vs 5.4% earlier), at 5.8% in Q4 FY21 (vs 4.5% earlier), and at 5.2% to 4.6% for H1 FY22, with risks broadly balanced.

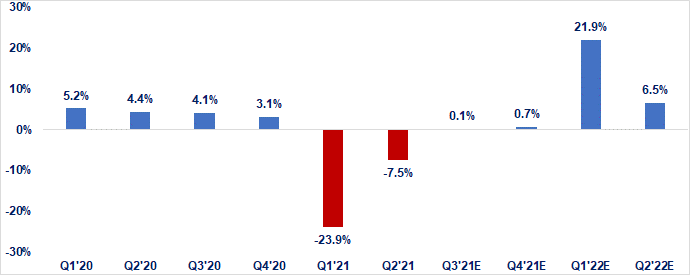

A positive development on the economic front, was that the RBI upgraded the GDP growth forecasts for the Indian economy. For FY21, RBI now forecasts GDP to contract 7.5%YoY, compared to a forecast of 9.5%YoY contraction in the October 2020 monetary policy review. The quarterly GDP growth forecasts have also been revised (Refer to chart below), and the central bank now expects GDP growth to turn positive in Q3 FY21 compared to earlier forecast of GDP growth turning positive in Q4 FY21. The RBI said that high frequency indicators point to recovery gaining traction but also mentioned that signs of recovery are far from being broad-based and are dependent on sustained policy support. Overall, risks for economic growth is broadly balanced.

India Quarterly GDP Growth Trend & Forecast (% YoY)

Source: MOSPI, RBI

Outlook:

The Indian economy has seen healthy recovery in high frequency indicators (better than expectations), with various economic trackers indicating that economic/business activity is back to ~95-100% of pre-pandemic levels at an aggregate level. Therefore, we too feel that economic contraction in FY21 may not be as sharp as projected earlier. Despite inflationary pressures, the central bank still maintained that it will continue with its accommodative stance through next fiscal year—indicating that it lays importance to supporting economic growth recovery. Although there were no major liquidity measures announced this time, the RBI mentioned that it stands ready to take further steps on liquidity and that on-tap TLTRO will be extended to other sectors.

With the central bank mentioning that inflation is expected to remain elevated (compared to mention of “transient” in previous policy) it provides limited space for further rate cuts, and future monetary action will be dependent on how the inflation trajectory pans out.

The bond markets have reacted positively, with G-Sec yields softening post the policy announcement. From an investment perspective on the fixed income side, we continue to prefer the medium-term part of the yield curve.

“The opinion expressed by the Author in this article/note is his personal opinion and readers are advised to seek independent financial advice before taking any investment decisions.”

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More