RBI Bi-monthly Policy, October 2019 – Comments by Chief Investment Officer

#

4th Oct, 2019

- 7721 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

RBI cuts rates by 25 basis points to address concerns of slowdown in economic growth

The RBI Monetary Policy Committee (MPC) voted to cut the policy repo rate by 25 bps, with all MPC members unanimously voting for a rate cut (5 members for 25 bps cut and 1 member for 40 bps cut). The MPC decided to continue with an ‘accommodative’ stance as long as it is necessary to revive growth, while ensuring that the inflation remains within the target. We believe that this is a dovish rate cut, with the possibility to reduce the rates further if needed. Even though some small sections of the market was expecting 40 bps rate cut, a 25bps rate cut along with dovish approach is positive for the market.

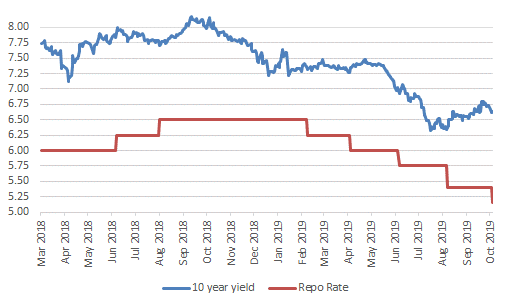

RBI Repo Rate Vs 10 year yield

Source: Bloomberg

Consumer Price Index (CPI) headline inflation for July-August has been in line with RBI’s inflation trajectory. RBI’s inflation projection has been revised slightly upwards to 3.4% for Q2FY20, while projections are retained for H2FY20. Overall, the inflation expectations are well anchored and benign, offering the opportunity for further rate reductions.

On the economic front, the central bank revised down the GDP growth forecast for FY20 sharply to 6.1% YoY (from 6.9% earlier). This is in the context of weak domestic growth (suggested by Q1FY20 GDP and various high frequency indicators) and concerns of global growth slowdown. Overall, the lowering of GDP growth estimate for the full year is a bit disappointing as growth recovery is still getting delayed.

Outlook:

With inflation being in control and weak domestic growth prospects, RBI’s focus continues to be addressing the slowdown in macro-economic environment. The MPC notes that the negative output gap has widened further. While MPC believes that the recent measures announced by the government are likely to strengthen private consumption and spur private investment activity, the continuing slowdown warrants intensified efforts to restore the growth momentum.

We believe that benign inflation outlook provides headroom for policy action to address these growth concerns by reinvigorating domestic demand, within the flexible inflation targeting mandate.

From an investment perspective, we presently prefer the shorter to medium end of the yield curve and have positioned our bond fund portfolio accordingly. We feel that markets may have largely discounted a large part of rate easing cycle, with bond yields having come down significantly over the past few months. With interest rates continuing to be low and liquidity remaining high in the system, it should be favorable for equities as well.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More