Private financials, consumption to drive earnings growth going ahead

#

29th Aug, 2018

- 732 Views

NDNC disclaimer: By submitting your contact details or responding to Bajaj Allianz Life Insurance Company Limited., with an SMS or Missed Call, you authorise Bajaj Allianz Life Insurance Company Limited and/or its authorized Service Providers to verify the above information and/or contact you to assist you with the purchase and/or servicing

After a while now, corporate earnings are showing signs of a recovery, and Q1FY19 corporate results have broadly been good, except in a few pockets.

This is helping in improving sentiment in the markets, and has helped the benchmarks, Sensex and Nifty, touch their life-time highs recently.

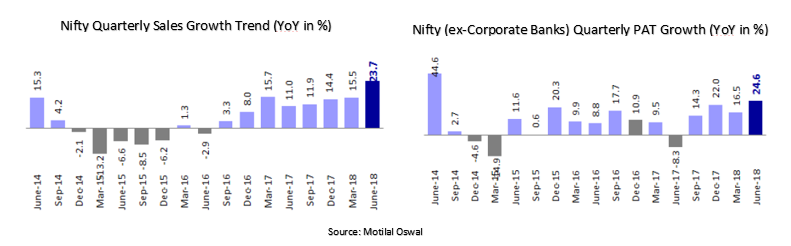

We saw strong volume growth in Q1FY19 results, and at an aggregate level – Nifty index sales growth was at a multi-year high of 23.7 percent YoY during the quarter.

The Nifty Profit after Tax (PAT) growth was below estimate at 10 percent YoY for the quarter, mainly dragged down by corporate banks, which declared lower growth due to higher provisioning during the quarter.

Excluding corporate banks, Nifty PAT growth was at a healthy 25 percent on a YoY basis, even if we account for a lower base effect.

Sectors that outperformed in Q1FY19 earnings:

Within the consumption space, FMCG sector saw strong volume growth. NBFCs registered strong growth during the quarter, and private banks (excl. corporate banks) also posted healthy results, in-line with market expectations.

Private banks continue to benefit from rising credit growth, and garner market share from their PSU counterparts.

Metals sector posted strong PAT growth during the quarter, and the oil & gas sector also delivered robust PAT growth — helped by a good performance by Oil Marketing Companies (OMCs), primarily on the back of inventory gains.

Capital goods sector also fared reasonably well during the quarter. Technology sector posted strong growth helped by a weak rupee and recovery in the US economy, and the healthcare sector also registered a healthy PAT growth after a long time.

We feel that the healthcare sector may have bottomed out, with most of the FDA related issues behind us now, pricing pressures easing somewhat, and with a weaker rupee aiding the sector.

Sectors that underperformed in Q1FY19 earnings:

PSU banks continued to post losses due to asset quality issues, although the quantum of losses reduced compared to the previous quarter. Corporate banks, too, underperformed due to higher provisioning during the quarter.

However, we feel that the asset quality related issues for these banks may be bottoming out now, and lower provisioning going forward may help to turn prospects for this long-beleaguered space, which has been a big drag on aggregate corporate earnings.

The telecom space also continued to generate losses, led by continued competition and sequential drop in ARPU (Average Revenue per User). Auto space was mainly dragged down by poor results from Tata Motors during the quarter. Cement sector saw flat PAT growth, which was below estimates.

Macro recovery to also aid earnings growth, but some headwinds remain:

Most high-frequency data at a micro-level point to a recovery in economic growth. However, some macro headwinds remain like elevated crude oil prices and its impact on the twin deficits, rising interest rates, and inflation.

Global uncertainty on escalating trade war, tightening of monetary policy by major central banks, and concerns of global risk aversion in emerging markets/currencies, also remain.

Conclusion & Outlook:

For the past few fiscal years, earnings growth projection for the markets have started on a positive note, only to be downgraded during the course of the year, and ultimately ending the year on a flat note.

This has led to muted earnings growth over the past few years, even as the benchmark indices have continued to rise.

The Nifty index EPS growth has been around 23 percent (absolute) over the past 5 fiscal years (ended March 2018), while the Nifty index has delivered 78 percent returns (absolute) over the same period.

This means that a bulk of the Nifty index returns (almost 70%) has come from P/E expansion over the past 5 years, as markets have run up in anticipation of a corporate earnings recovery, and driven by strong liquidity.

However, we expect this to change going forward, as we feel that earnings growth (and not P/E expansion) will drive the markets going ahead.

Earnings growth is expected to jump over 15 percent plus CAGR in FY19 and FY20, and if this pans out as expected, we may even see a compression in market P/E multiple, which seems relatively elevated at current levels.

The sectors that we expect to drive earnings growth going forward are private financials and consumption related themes. The recovery in earnings growth is also expected to be aided by earlier underperforming sectors, which we feel may have bottomed out—like Corporate banks and Pharma.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More